By Barbara Thomas November 29, 2024

In today’s digital age, credit card machines have become an essential tool for businesses of all sizes. These machines allow merchants to accept payments from customers using credit or debit cards, providing convenience and flexibility for both parties involved. However, understanding how to use a credit card machine effectively is crucial to ensure smooth transactions and avoid any potential issues.

In this comprehensive guide, we will explore the different types of credit card machines, how to set them up, process payments, troubleshoot common issues, and implement best practices for optimal usage. Additionally, we will discuss security measures, integrating additional features and services, and address frequently asked questions to provide a holistic understanding of credit card machine usage.

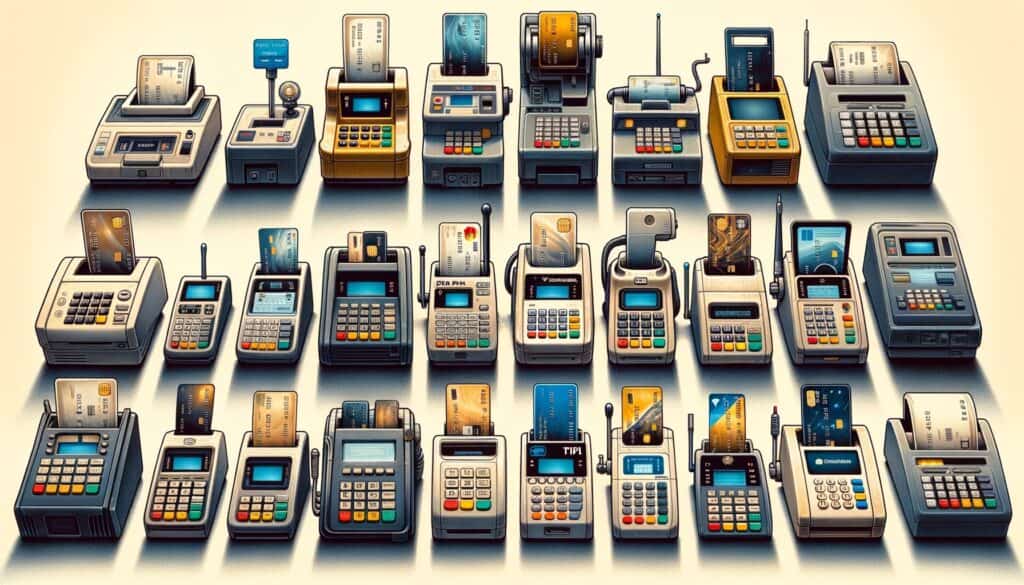

Understanding the Different Types of Credit Card Machines

Credit card machines come in various types, each with its own set of features and functionalities. It is important to understand these differences to choose the right machine for your business needs. The three main types of credit card machines are traditional countertop machines, wireless machines, and mobile card readers.

1. Traditional Countertop Machines

These machines are commonly found in retail stores and restaurants. They are connected to a phone line or internet connection and require a physical card to be swiped or inserted. Traditional countertop machines offer reliability and stability, making them suitable for businesses with a fixed location.

2. Wireless Machines

Wireless credit card machines are ideal for businesses that require mobility, such as food trucks or delivery services. These machines use cellular networks to process transactions, eliminating the need for a physical connection. Wireless machines offer convenience and flexibility, allowing transactions to be conducted anywhere within the network coverage area.

3. Mobile Card Readers

Mobile card readers are small devices that can be attached to smartphones or tablets. They enable businesses to accept payments on the go, making them popular among small businesses and independent contractors. Mobile card readers connect to the device via Bluetooth or audio jack, transforming it into a portable payment terminal.

Setting Up Your Credit Card Machine

Once you have chosen the appropriate credit card machine for your business, the next step is to set it up correctly. Proper setup ensures seamless transactions and minimizes any potential issues. Here are the key steps to follow when setting up your credit card machine:

1. Choose a Merchant Account Provider

Before setting up your credit card machine, you need to establish a merchant account with a reputable provider. A merchant account acts as a bridge between your business and the payment processor, allowing you to accept credit card payments. Research different providers, compare fees and services, and choose the one that best suits your business requirements.

2. Connect the Machine to Power and Network

Depending on the type of credit card machine, you will need to connect it to a power source and network. Traditional countertop machines usually require a power outlet and an internet connection or phone line. Wireless machines rely on cellular networks, so ensure that you have a strong signal. Mobile card readers connect to smartphones or tablets via Bluetooth or audio jack, eliminating the need for additional power sources.

3. Configure the Machine

Once the physical connections are established, you need to configure the credit card machine. Follow the instructions provided by the manufacturer to set up the machine’s settings, such as language, time zone, and receipt preferences. Additionally, you may need to input your merchant account details to link the machine to your payment processor.

4. Test the Machine

Before accepting actual payments, it is crucial to test the credit card machine to ensure it is functioning correctly. Perform a test transaction using a test card provided by your merchant account provider. This allows you to verify that the machine can process payments, print receipts, and reconcile transactions accurately.

Processing Payments with a Credit Card Machine

Once your credit card machine is set up, you can start accepting payments from customers. The process may vary slightly depending on the type of machine and payment method used. Here is a general overview of how to process payments with a credit card machine:

1. Select the Payment Type

When a customer is ready to make a payment, you need to select the appropriate payment type on the credit card machine. This could include options such as credit card, debit card, or contactless payment methods like Apple Pay or Google Pay.

2. Enter the Transaction Amount

After selecting the payment type, you will be prompted to enter the transaction amount on the credit card machine. Ensure that the amount is accurate and matches the customer’s purchase.

3. Swipe, Insert, or Tap the Card

Depending on the type of credit card machine, you will either swipe the card through a magnetic stripe reader, insert it into an EMV chip reader, or tap it on a contactless payment terminal. Follow the on-screen instructions and wait for the machine to read the card information.

4. Verify Cardholder Information

Once the card is read, the credit card machine will display the cardholder’s information, such as the name and the last four digits of the card number. Verify this information with the customer’s card and ask for identification if necessary.

5. Obtain Cardholder’s Signature

If the transaction requires a signature, the credit card machine will prompt the customer to sign on the screen or a paper receipt. Ensure that the signature matches the one on the card and the customer’s identification, if applicable.

6. Process the Transaction

After verifying the cardholder’s information and obtaining their signature, you can proceed to process the transaction. The credit card machine will communicate with the payment processor to authorize the payment and deduct the amount from the customer’s account.

7. Print or Email the Receipt

Once the transaction is approved, you can provide the customer with a receipt. Traditional countertop machines have built-in printers that can produce paper receipts, while wireless machines and mobile card readers can send digital receipts via email or text message.

Troubleshooting Common Issues with Credit Card Machines

Despite their reliability, credit card machines can encounter occasional issues that may disrupt the payment process. Being aware of common problems and their solutions can help you troubleshoot and resolve these issues promptly. Here are some common issues you may encounter with credit card machines and how to address them:

1. Connection Problems

If your credit card machine is unable to establish a connection to the network, it may result in transaction failures. Ensure that the machine is properly connected to the power source and network. If using a wireless machine, check for a strong cellular signal. Restarting the machine or contacting your merchant account provider for technical support can also help resolve connection issues.

2. Card Reading Errors

Sometimes, credit card machines may have difficulty reading cards, leading to transaction failures or errors. Ensure that the card is inserted or swiped correctly, and the machine’s card reader is clean and free from debris. If the problem persists, try using a different card or contact your merchant account provider for assistance.

3. Declined Transactions

Occasionally, a credit card machine may display a “declined” message, indicating that the transaction was not authorized by the cardholder’s bank. In such cases, ask the customer to provide an alternative payment method or contact their bank for further information. It is also advisable to check if the machine’s software is up to date, as outdated software can sometimes cause authorization issues.

4. Printer Malfunctions

For traditional countertop machines with built-in printers, printer malfunctions can occur, resulting in the inability to print receipts. Check if the printer has enough paper and ink, and ensure that the paper is properly loaded. If the issue persists, contact your merchant account provider or the machine’s manufacturer for assistance.

5. Power Outages

Power outages can disrupt credit card machine operations, especially for traditional countertop machines that rely on a constant power source. Consider investing in a backup power supply, such as an uninterruptible power supply (UPS), to ensure uninterrupted operations during power outages.

Best Practices for Using a Credit Card Machine

To optimize the usage of your credit card machine and provide a seamless payment experience for your customers, it is essential to follow best practices. Implementing these practices can help minimize errors, enhance efficiency, and ensure customer satisfaction. Here are some best practices for using a credit card machine:

1. Train Your Staff

Properly train your staff on how to use the credit card machine effectively. Ensure that they are familiar with the machine’s features, transaction process, and troubleshooting techniques. Regularly update their knowledge to keep up with any software or hardware changes.

2. Keep the Machine Clean

Regularly clean the credit card machine to maintain its functionality and appearance. Use a soft, lint-free cloth to wipe the machine’s surfaces, including the screen, keypad, and card reader. Avoid using harsh chemicals or abrasive materials that may damage the machine.

3. Secure the Machine

Protect your credit card machine from theft or unauthorized access by securing it in a visible and monitored location. Consider using security cables or mounts to prevent theft or tampering. Additionally, restrict access to the machine’s settings and administrative functions to authorized personnel only.

4. Regularly Update Software

Ensure that your credit card machine’s software is up to date. Regular software updates often include security patches, bug fixes, and new features that enhance the machine’s performance and protect against potential vulnerabilities. Check for updates provided by the machine’s manufacturer or your merchant account provider.

5. Reconcile Transactions Daily

To maintain accurate financial records, reconcile your credit card machine’s transactions daily. Compare the total sales recorded on the machine with your business’s daily sales report. This helps identify any discrepancies or potential issues promptly.

Ensuring Security and Fraud Prevention with Credit Card Machines

Security and fraud prevention are paramount when using credit card machines. Protecting your customers’ sensitive information and preventing fraudulent activities not only safeguards your business’s reputation but also ensures compliance with industry regulations. Here are some measures to ensure security and fraud prevention with credit card machines:

1. PCI Compliance

Ensure that your credit card machine and payment processing system comply with the Payment Card Industry Data Security Standard (PCI DSS). PCI DSS sets guidelines for securely handling, storing, and transmitting cardholder data. Regularly assess your compliance and implement necessary measures to protect sensitive information.

2. Encryption and Tokenization

Implement encryption and tokenization technologies to secure cardholder data during transmission and storage. Encryption converts data into unreadable code, while tokenization replaces sensitive data with unique tokens. These technologies add an extra layer of security, making it difficult for hackers to access or misuse cardholder information.

3. EMV Chip Technology

Utilize credit card machines that support EMV chip technology. EMV chips provide enhanced security compared to magnetic stripes, as they generate unique transaction codes for each payment, making it difficult for fraudsters to replicate or reuse card data. Encourage customers to use chip-enabled cards whenever possible.

4. Two-Factor Authentication

Implement two-factor authentication for accessing the credit card machine’s settings or administrative functions. This adds an extra layer of security by requiring users to provide a second form of verification, such as a unique code or biometric authentication, in addition to their login credentials.

5. Regularly Monitor Transactions

Monitor your credit card machine’s transactions regularly to identify any suspicious activities or patterns. Look for unusual transaction amounts, multiple declined transactions, or an unusually high number of refunds. Report any suspicious activities to your merchant account provider or payment processor immediately.

Integrating Additional Features and Services with Your Credit Card Machine

Credit card machines offer various additional features and services that can enhance your business operations and customer experience. Integrating these features can streamline processes, increase efficiency, and provide added convenience. Here are some additional features and services you can integrate with your credit card machine:

1. Contactless Payments

Consider enabling contactless payment options, such as Near Field Communication (NFC) or Quick Response (QR) code payments. These methods allow customers to make payments by simply tapping their card or scanning a QR code, reducing transaction time and enhancing convenience.

2. Loyalty Programs

Integrate your credit card machine with a loyalty program to reward customers for their repeat business. Loyalty programs can be linked to the machine, allowing customers to earn points or discounts based on their purchases. This encourages customer loyalty and increases engagement.

3. Gift Cards

Offering gift cards can boost sales and attract new customers. Integrate your credit card machine with a gift card program that allows customers to purchase and redeem gift cards directly at the point of sale. This simplifies the process and encourages customers to return to your business.

4. Inventory Management

Integrate your credit card machine with an inventory management system to track and manage your stock effectively. This allows you to monitor product availability, automate reordering processes, and generate reports on sales and inventory levels. Streamlining inventory management reduces errors and improves overall efficiency.

5. Analytics and Reporting

Utilize credit card machines that provide analytics and reporting capabilities. These features allow you to generate detailed reports on sales, transaction volumes, and customer behavior. Analyzing this data helps you make informed business decisions, identify trends, and optimize your operations.

Frequently Asked Questions

Q1. Can I use a credit card machine without a merchant account?

No, a merchant account is required to use a credit card machine. It acts as a bridge between your business and the payment processor, allowing you to accept credit card payments.

Q2. How long does it take to set up a credit card machine?

The setup time for a credit card machine varies depending on the type of machine and the merchant account provider. It can range from a few minutes to a few days, considering the time required for account approval and machine configuration.

Q3. Can I accept international credit cards with my credit card machine?

Yes, most credit card machines support international credit cards. However, it is advisable to check with your merchant account provider to ensure compatibility and understand any additional fees or requirements.

Q4. What should I do if my credit card machine is stolen?

If your credit card machine is stolen, immediately report the incident to the authorities and your merchant account provider. They can assist in deactivating the machine and taking necessary measures to prevent unauthorized access or fraudulent activities.

Q5. How often should I update my credit card machine’s software?

It is recommended to update your credit card machine’s software as soon as new updates are available. Regular software updates often include security patches and bug fixes that protect against potential vulnerabilities.

Conclusion

Credit card machines have revolutionized the way businesses accept payments, providing convenience and flexibility for both merchants and customers. Understanding how to use a credit card machine effectively is crucial to ensure smooth transactions and avoid any potential issues.

By familiarizing yourself with the different types of credit card machines, setting them up correctly, processing payments accurately, and troubleshooting common issues, you can optimize the usage of these machines and provide a